Banking in Sweden

Bank and services

It is strongly recommended that exchange students staying in Sweden for less than six months make banking arrangements from their home bank. Students staying in Sweden for less than 12 months will experience difficulties to open a bank account. Most credit cards are accepted in Sweden. If you have a credit card from your bank in your home country you can use it in Sweden.

If you are staying in Sweden for a longer period it will be much easier for you to manage your day-to-day financial matters, such as paying you rent and other bills, if you have a banking relationship with a Swedish bank.

Do not bring large amounts of cash to the bank. Money laundering legislation requires the bank to ask questions about large cash transactions. If a customer does not present identification or provide a satisfactory explanation as to why the customer wants the bank to perform a certain service, the bank is not permitted to perform the requested service under the risk of criminal penalties and sanctions.

Do not use traveler’s or bank cheques.

In Sweden, banks are generally open Monday to Friday 10.00 to 15.00 (3pm). Some banks have extended opening hours on Mondays and Thursdays. There are several different banks available in Jönköping. There is no specific bank connected to Jönköping University. Most Swedish banks will charge you fees for different services. Ask about fees before choosing your bank.

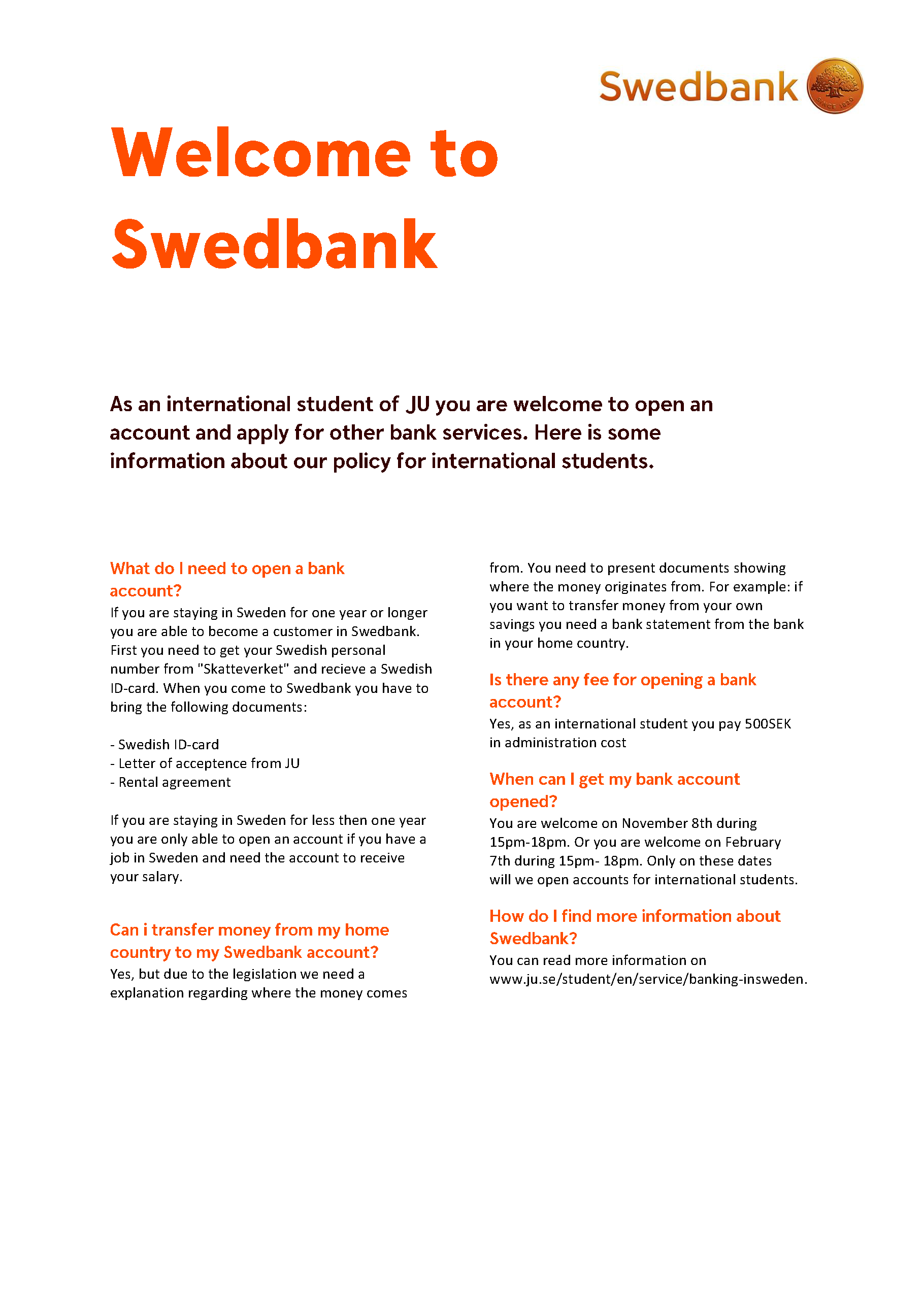

Opening an account

The different bank branches require different documentation from you as an international customer. Requirements for opening a Swedish bank account normally include a minimum stay of 12 months as well as a Swedish personal identity number (for some or all services). Students staying in Sweden for less than 12 months can obtain a bank account with limited services. For examples is online payments limited for bank accounts to customers with minimum stay of 12 months, Swedish personal identity number and a Swedish ID-Card. Usually it takes 6-8 weeks to get a bank account.

When you apply for a Swedish bank the following documents is required:

- Passport

- Residence permit

- Address information (rental agreement)

- Letter of acceptance from Jönköping University

- Information about tax residence etc

- Swedish ID-card if you have obtained a Swedish personal identity number

- Filled in application for bank account

When opening a Swedish account, ask for your IBAN code and SWIFT code, which enables you or your family to easily transfer money from your home account to your Swedish account.

Swedish personal identity number

A Swedish personal identity number can only be obtained if you have a residence permit valid in Sweden for 12 months or longer. (EU citizens need to prove they will be in Sweden for more than 365 days). You apply for the Swedish personal number through the Swedish Tax Agency (Skatteverket) once you arrive in Sweden.

Adress to Skatteverket Jönköping: Trädgårdsgatan 7, Jönköping.

If you have received a Swedish personal identity number, you need to inform the university since that information does not reach us automatically. Please visit the Service Center and bring your JU-card and the decision from Skatteverket (or an ID-card with the Swedish personal number on it).

Swedbank

Address: Hoppets torg 4b

Phone: +46 36 - 19 67 00

SEB

At SEB you need to book an appointment before visiting the bank.

If you as an international student wish to open a bank account there are new routines for this.

Here is a link to the digital application at SEB - New in Sweden External link, opens in new window.

Address: Södra strandgatan 13

Phone: +46 771 - 365 365